INSIGHTS

UNDERSTANDING YOUR TAX CREDIT OPTIONS IS ESSENTIAL FOR SUCCESS

Providing in-depth analysis on the industry’s more complex matters for those interested in tax equity investment.

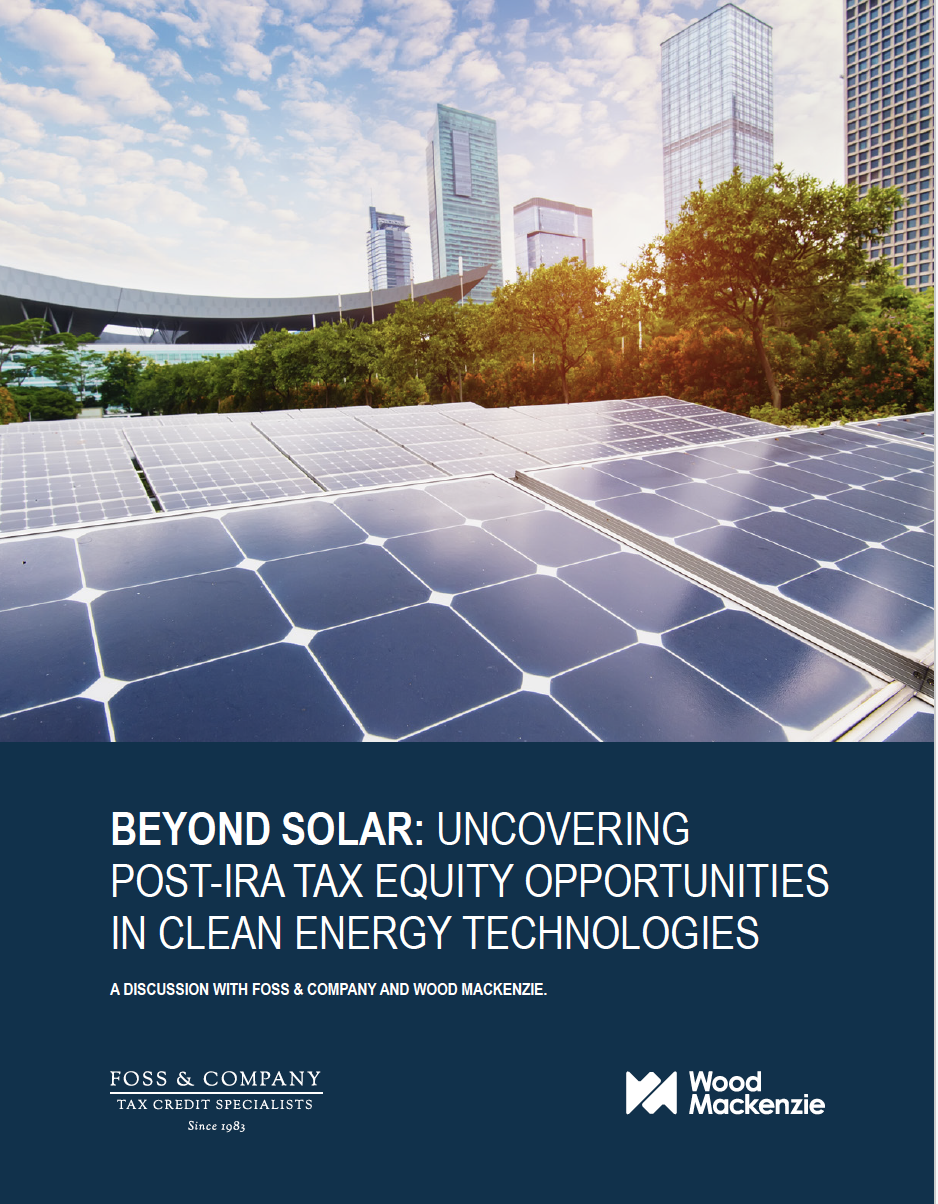

BEYOND SOLAR: UNCOVERING POST-IRA TAX EQUITY OPPORTUNITIES IN CLEAN ENERGY TECHNOLOGIES

By Bryen Alperin, Foss & Company and Wood Mackenzie

It’s not hyperbole to say that the investment tax credit (ITC) and production tax credit (PTC) have provided the financial resources necessary for the rapid growth of wind, solar, and more recently, energy storage across America.

There are myriad reasons why tax credits and the equity financing they enable have emerged to take such a central role in the transition to a decarbonized electric power system.

Download the paper to learn more about how tax equity and transferability will help supply the capital the energy transition.

WHITE PAPERS

Beyond Solar: Uncovering Post-IRA Tax Equity Opportunities in Clean Energy Technologies

By jwigg |

It’s not hyperbole to say that the investment tax credit (ITC) and production tax credit (PTC) have provided the financial resources necessary for the rapid growth of wind, solar, and more recently, energy storage across America. There are myriad reasons why tax credits and the equity financing they enable have emerged to take such a…

Navigating Renewable Energy Tax Credits Through Election 2024

By jwigg |

By Foss & Company’s Byen Alperin, Partner & Managing Director As the 2024 U.S. presidential election looms, the stakes for the clean energy sector have never been higher, says Bryen Alperin of Foss & Company. Renewable energy tax credits have been a vital tool for fostering sustainable solutions across the nation, spurring substantial investment in emergent technologies…

Investing in Renewable Energy Tax Credits Without Recaptures

By jwigg |

By Foss & Company’s Bryen Alperin, Partner & Managing Director and Sophie Gunderson, Associate Vice President Renewable Energy Project Finance Renewable energy tax credits can provide a significant reduction in tax liability with practically no risk of recapture due to a §50 disqualifying event during a project’s five-year compliance period – with exercise of…

Transferable Tax Credit Due Diligence Checklist

By jwigg |

By David Burton, Norton Rose Fullbright; Bryen Alperin, Foss & Company; Gary Blitz, Aon; with contributions from Amber Peterson, Winthrop & Weinstine When preparing for a transferable tax credit transaction, a due diligence checklist informs the conversation, identifies impediments to the transaction, and allows stakeholders to focus on strategy, structure, and deal execution. This checklist…

Capitalizing on the Green Transition

By christina |

Tax Credits & Corporate Leadership Environmental, social and governance (ESG) analysis has matured rapidly over the last half- decade, becoming increasingly incorporated into investment decision-making processes. ESG-aligned investments will ensure that companies use their financial resources to address urgent social and environmental problems, while still capitalizing on the investment to ensure aligned incentives. As investors…

GAAP ACCOUNTING FOR ALLOCATED TAX CREDIT INVESTMENTS

By foss admin |

GAAP Accounting for Allocated Tax Credit Investments: Utilizing the Deferral Method to Recognize Renewable Energy Tax Credits There are two ways a company can account for an allocated tax credit: Flow through/tax reduction method or Deferral/cost reduction method. The deferral method presents some advantages that address perceived adverse accounting presentation inherent in renewable equity structures. Using the deferral method…

IRA MARKET INSIGHTS – OCTOBER 2022

By Churchill |

Notes on the inflation reduction act for tax credit investors IRA 101 for TAX CREDIT INVESTORS – More Availability, Certainty, and Flexibility The “Inflation Reduction Act of 2022” (IRA) signed into law on August 16, 2022, expanded the volume, scope, and accessibility of tax credits available to institutional investors. This legislation intends to accelerate the…

Community Solar 2.0: Expanding Access and Opportunity

By christina |

As scorching temperatures and violent storms make the perils of climate change increasingly plain, and with energy prices rising at a rapid rate, consumers, investors, entrepreneurs and even name-brand companies are turning an eye to the untapped potential of community solar energy. Accessible, affordable and entirely renewable, community solar sits in the space between individual…

Annual Report on the Economic Impact of the Federal Historic Tax Credits for Fiscal Year 2021

By christina |

Properties financed by equity from the federal historic tax credit (HTC) generated 135,000 jobs and $8 billion in total rehabilitation investment in 2021, according to the Annual Report on the Economic Impact of the Historic Tax Credit for Fiscal Year 2021, was released by Rutgers University and the National Park Service. The jobs total was…

TAX CREDIT INCENTIVES FOR CARBON SEQUESTRATION: POTENTIALLY THE MOST IMPACTFUL U.S. POLICY TO BATTLE CLIMATE CHANGE

By johnny |

The Bipartisan Budget Act of 20181 expanded the §45Q2 tax credit, the most important federal incentive for encouraging private investment in the development and use of carbon capture technologies and facilities. Tax credits for the capture and long-term, permanent storage of carbon oxides generate a competitive financial return and have a positive environmental impact on…

Tax Aspects of Renewable Energy Transactions: Renewable Investment Incentives, Transaction Structures, and Tax Matters – March 2021

By Churchill |

Intended to promote production of energy from renewable energy resources, renewable energy tax credit programs provide a variety of federal and state subsidies, credits, and incentives to finance the investment and production of renewable energy. This white paper provides detailed insights into renewable energy transactions, showcasing to new investors that they can efficiently optimize the…

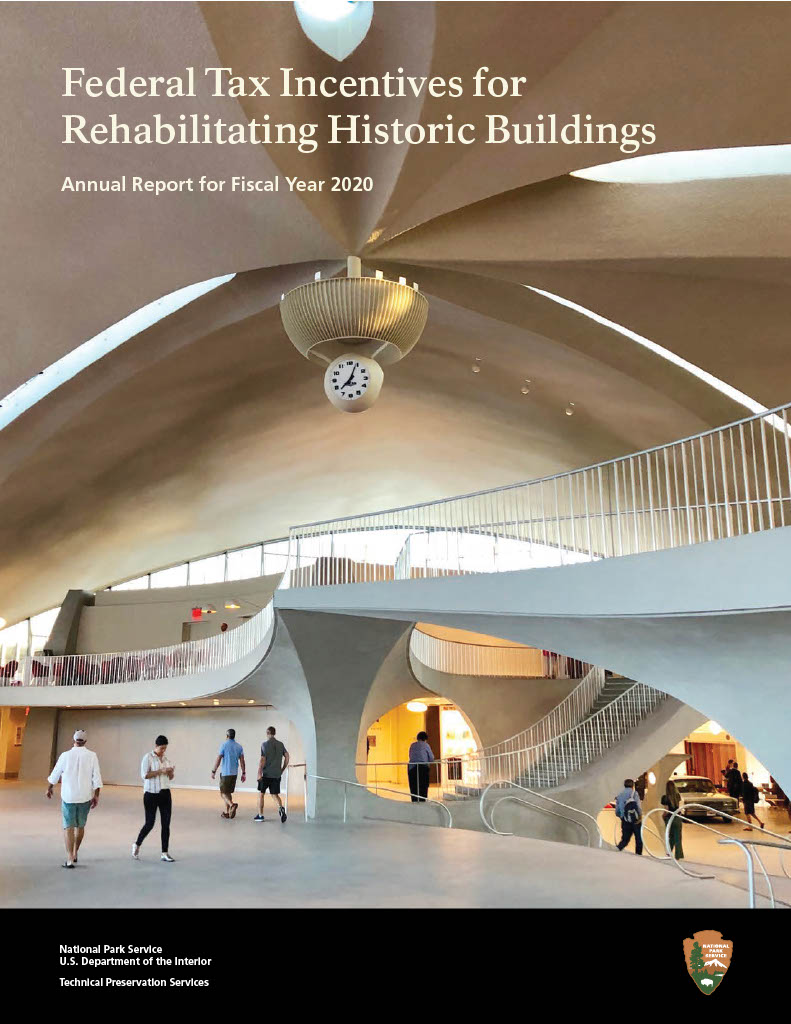

Federal Tax Incentives for Rehabilitating Historic Buildings

By Churchill |

The Federal Historic Preservation Tax Incentives Program is the nation’s most effective program to promote historic preservation and community revitalization through historic rehabilitation. It generates much needed jobs and economic activity, enhances property values in older communities, creates affordable housing, and augments revenue for Federal, state, and local governments. The Federal Tax Incentives for Rehabilitating…

TAX CREDIT INVESTMENTS ARE ESG INVESTMENTS

By Churchill |

Institutional investors and corporates inject over $25 billion per year into the allocated tax credit market. However, Foss & Company research suggests there are still billions of dollars of tax capacity available that could be deployed into tax equity markets to support environmental and sustainability projects. Download White Paper

COVID-19 Tax Credit Market Impact Survey Results

By Churchill |

In an effort to aid our investor, developer, and service partners in the tax equity marketplace, we performed a survey on the marketplace’s response to COVID-19. Questions included themes of market trends, volume, credit pricing, and buy-side investment underwriting. Download White Paper

Allocated Tax Credit Advancements

By Churchill |

Intended to promote production of energy from renewable energy resources, renewable energy tax credit programs provide a variety of federal and state subsidies, credits, and incentives to finance the investment and production of renewable energy… Download White Paper

A Post-Tax Reform Primer on U.S. Tax Credits

By Churchill |

A lower tax rate won’t necessarily leave corporations in the best possible situation. The tax law curtailed or eliminated many business deductions, such as putting new limits on interest deductions and a new ceiling on, and repeal of carrybacks for, net operating losses… Download White Paper