UNLOCK THE POTENTIAL OF TAX CREDITS WITH A TRUSTED PARTNER

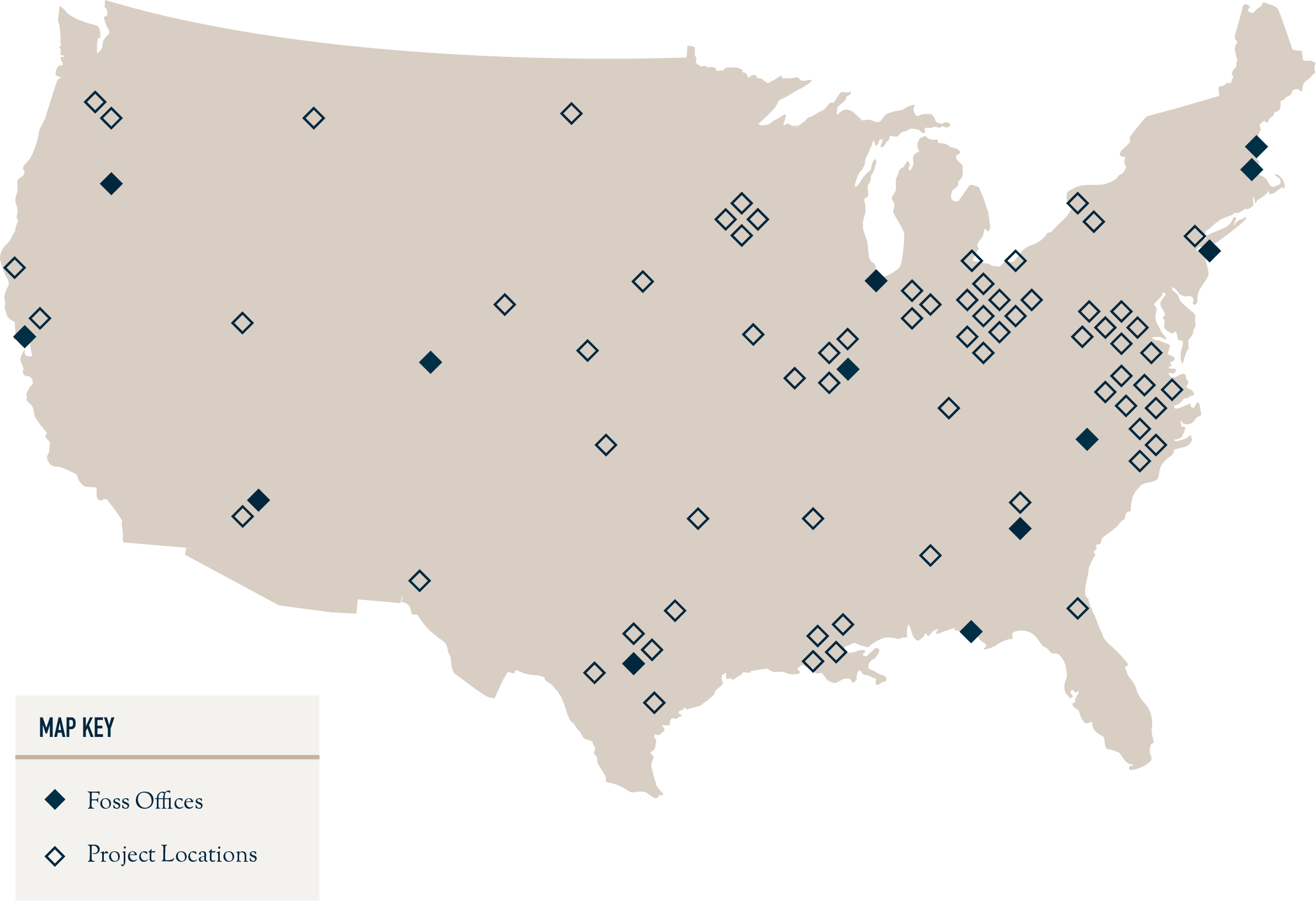

At Foss & Company, we transform tax credit opportunities into sustainable investments that maximize returns. With 40+ years of experience and a track record as the industry’s most trusted, reliable and successful tax credit sponsor, we help our partners achieve results with confidence.

40+ YEARS OF UNMATCHED TAX CREDIT EXPERTISE

Foss & Company has been at the forefront of the tax credit industry since 1983. With our deep knowledge and extensive network, we have successfully raised over $8 billion in equity, delivering superior risk-adjusted returns to our investors. Our comprehensive suite of tax credit programs includes historic preservation tax credits, solar tax credits, carbon capture tax credits, battery energy storage tax credits, low-income housing tax credits, and other renewable energy tax credits. We are proud to have served our partners for over 40 years and look forward to continuing our dedicated service for many more years to come.

HISTORIC PRESERVATION

We work with institutional investors across the country to identify the best tax credit investment solutions to meet their objectives, providing access to large-scale renewable energy projects in solar, battery storage, and carbon capture. With industry-leading expertise, we connect investors with projects that deliver strong returns and measurable impact while advancing ESG initiatives.

CLEAN ENERGY

Unlock financial opportunities with Foss & Company’s approach to transferring clean energy tax credits. Our expertise and relationships enable corporate taxpayers to turn credits into meaningful outcomes. We provide clear guidance and a seamless process that reduces risk, ensures compliance, and helps you navigate the evolving landscape of clean energy policy with confidence.

TRANSFERABLE TAX CREDITS

Foss & Company is your trusted partner in unlocking the power of tax credits to drive social, environmental, and economic benefits. Our full-service team manages transactions from inception to completion, working with developers to qualify investments, coordinate partners, and streamline management. Whether advancing historic preservation, clean energy, or carbon capture, we provide the expertise to reduce risk and maximize value every step of the way.

LEVERAGING TAX CREDITS FOR SOCIAL & ENVIRONMENTAL IMPACT

Foss & Company is your trusted partner in unlocking the power of tax credits to drive social, environmental, and economic benefits. Our full-service approach ensures a seamless experience from project inception to completion. We work closely with developers to source quality transactions, negotiate favorable terms, and provide underwriting, asset management, and investor reporting services. Whether you're a developer seeking tax equity or an institutional investor looking to optimize your tax management and impact investing strategy, we have the expertise to guide you every step of the way.

INVESTORS

Investing in tax credits offers a unique opportunity to achieve risk-adjusted returns through highly structured project finance transactions. At Foss & Company, we understand the complexities of tax credit investments and leverage our expertise to create sustainable and profitable opportunities for our investors. Whether you're a bank, insurance company, or Fortune 500 company with significant tax liabilities, our team will tailor a tax credit investment strategy that aligns with your goals and maximizes your returns.

DEVELOPERS

At Foss & Company, we understand the importance of driving positive change in communities through tax credit projects. We have a long-standing reputation as the nation's most successful tax credit sponsor. Our experienced team is here to help developers like you unleash the potential of tax credit investments. With a comprehensive range of services and a proven track record, we offer end-to-end support, from sourcing quality transactions to managing investor relationships. Our streamlined processes and deep industry knowledge ensure smooth project execution and optimal results.

REST IN PEACE

Joe Foss

April 23, 1939 - June 1, 2018

REST IN PEACE

Ingrid Anders

July 9, 1979 - July 16, 2024

PARTNER WITH FOSS & COMPANY FOR TAX CREDIT SUCCESS

Ready to explore the vast potential of tax credit investments?

Contact the experienced team at Foss & Company today. Let us help you unlock the value of historic preservation, solar, and renewable energy tax credits for sustainable investments that drive both financial and social impact. Together, we can create a brighter and greener future.