ESG INVESTING

SEEKING TO LEVERAGE YOUR TAX CREDIT EQUITY TO MEET YOUR ESG GOALS

Make your investments mean something

Foss & Company and our investors are committed to moving the needle toward a more sustainable and just future. Undertaking the implementation of ESG tax credit programs can appear challenging, but Foss & Company can help corporations and institutional investors through the process with direct investment transactions or through our tax equity investment funds.

HOW DOES TAX EQUITY APPLY IN ESG INVESTING?

Tax equity investments are an underutilized strategy for boosting ESG performance and reducing ESG risk exposure. Transactions that pair the tax credits generated by a qualifying investment with the financing associated with that investment enables corporate investors to put their capital to work in funds, organizations, companies, or projects that seek to generate a positive, measurable social or environmental impact alongside a financial return.

Federal and state governments offer tax credits to promote public private partnerships, incentivizing investment capital to flow to domestic programs that benefit society, the nation and communities, such as:

BUILDING SUSTAINABLE ENERGY INFRASTRUCTURE THROUGH SOLAR INVESTMENT, WIND, FUEL CELL, & BIOGAS

Tax Credit Program: ITC/PTC, IRC Sections 48 and 45

CARBON SEQUESTRATION ACTIVITIES THAT REDUCE GREENHOUSE GAS EMISSIONS FROM U.S. INDUSTRIES

Tax Credit Program: PTC, IRC Section 45Q

PRESERVING AMERICA’S HISTORICAL BUILDINGS AND REPURPOSING THOSE FACILITIES TO THE BENEFIT OF COMMUNITIES

Tax Credit Program: HTC, IRC Section 47

BUILDING AFFORDABLE HOUSING FOR OUR NATION’S EVER-INCREASING POPULATION IN NEED OF AFFORDABILITY

Tax Credit Program: LIHTC, IRC Section 42

ESG FOSTERS FUTURE SUCCESS

As social and environmental factors become more tangible, a strong ESG proposition can safeguard a company’s long-term success. According to global consulting firm McKinsey & Company, a strong ESG proposition creates company value in five essential ways:*

1. Top-line growth – achieve higher valuations than competitors with lower social capital

2. Cost reductions – help combat rising operating costs

3. Reduced regulatory & legal interventions – achieve greater strategic freedom, easing regulatory pressure

4. Employee productivity uplift – help companies enhance employee motivation and increase productivity

5. Investment & asset optimization – enhance returns by allocating capital to more sustainable opportunities

*McKinsey and Company, “Five Ways that ESG Creates Value,” 2019

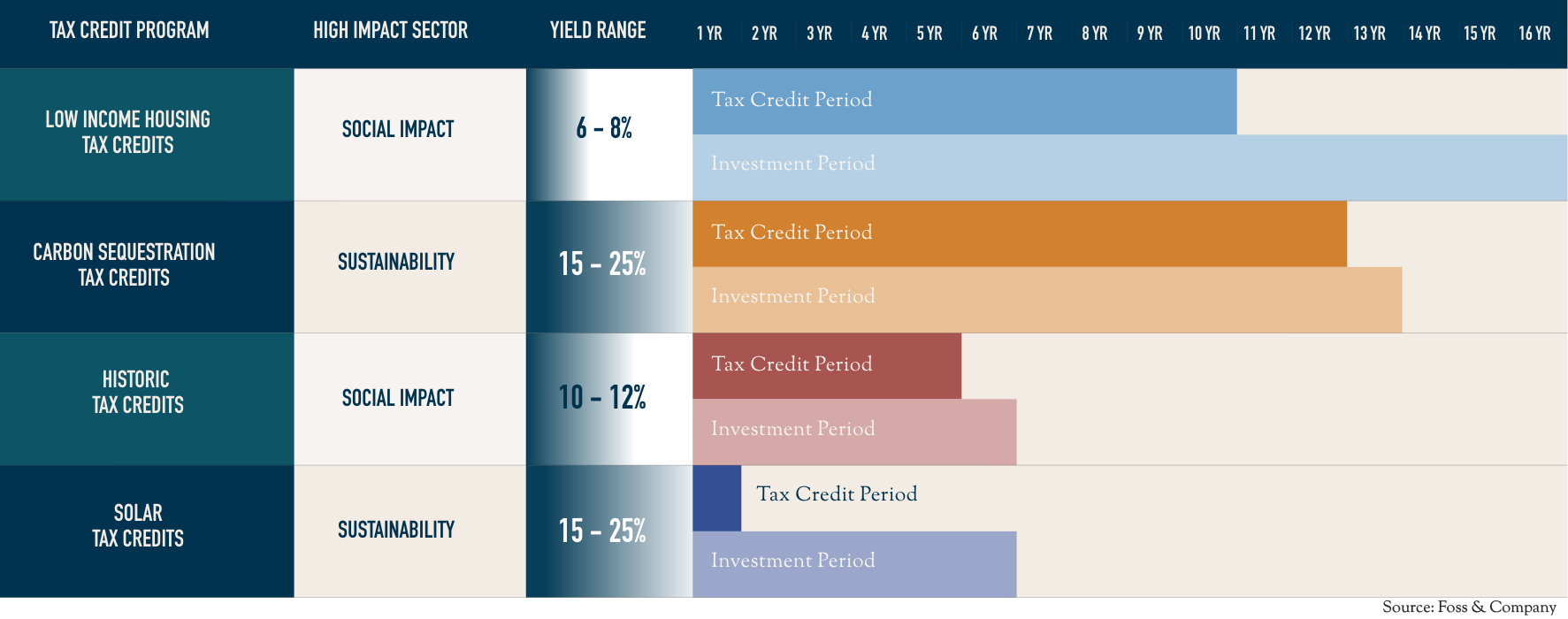

U.S. FEDERAL ALLOCATED TAX CREDIT PROGRAMS WITH ESG IMPACT