Investment Tax Credits: An Underrated Tool Delivering Financial & ESG Benefits

It is rare to find a multi-functional, multi-faceted “Tool” that creates a “win-win-win” outcome in the world of corporate finance. Fortunately, there is a Tool that creates value across multiple corporate areas simultaneously, but it is little known, often overlooked, and certainly underused.

This Tool is the Investment Tax Credit (ITC). Approved by the U.S. Congress, enshrined in the Internal Revenue Code, and encouraged by the federal government, ITCs allow those with a US tax liability to redirect their federal income tax obligation towards specific economic sectors or qualified projects. In other words, with the blessing of Uncle Sam, a company can repurpose its tax liability and invest in ESG (Environmental, Social and Governance) initiatives and reap a financial reward.

Unfortunately, ITCs continue to be underutilized despite the benefits afforded to corporations seeking to deploy impactful strategies to manage tax rates and create shareholder value. Let’s be honest, the tax strategy of a corporation may often be disregarded and undervalued. Tax departments tend to be isolated from the executive floors and often excluded from strategic decisions.

Perhaps it is time for the C-Suite to pay more attention to their tax teams. Similarly, it’s also time for the market (i.e., equity research analysts and portfolio managers) to pay closer attention to what companies are doing below the standard EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) line with regards to tax strategies and give them credit when these strategies lead to secondary, yet impactful, noble causes. Admittedly, it is not an easy (or exhilarating) task. For one, understanding the Tax Code is daunting. In addition, companies tend not to disclose much about their tax strategies. Other than the effective tax rate or “ETR” (actual income tax paid/EBT), and the occasional disclosure of the impact of “extraordinary” or “discrete” items, not much else is shared.

Financial Benefits of ITCs

Financial benefits derived from tax credits are obvious, but still worth highlighting.

Lower Effective Tax Ratio (“ETR”) – A tax credit is much more impactful than a tax deduction. A tax deduction lowers a company’s taxable income base, to which a corporate tax rate is then applied. On the other hand, a tax credit is a dollar-for-dollar reduction in a company’s already calculated income tax liability. By reducing the amount of actual income taxes paid, a company’s ETR falls. In fact, some active tax credit investors have disclosed lowering their ETRs by 50%.

Improvement in Net Earnings & Profitability – Every tax dollar that is reduced in the Profit & Loss Statement flows directly and entirely down to a company’s bottom line. This means a company’s net earnings will increase by that amount, which will have a concomitant positive impact on all profitability ratios (i.e., Net Profit Margin, Return on Assets, Return on Equity, etc.).

Valuation Accretion – Thanks to the increase in earnings and profitability, assuming market multiples staying the same, there will be an accompanying improvement in a company’s share price and market valuation. Example: A company with a P/E ratio of 20 will be valued at $200 million if Net Income is $10 million. However, if that company’s Net Income improves by $1 million to $11 million thanks to Tax Credits, its valuation will increase to $220 million, a 10% boost.

Possible Multiple Expansion – In light of the ESG movement across industries, the market may (will likely) start rewarding companies that show a genuine and real effort towards sustainability and environmental initiatives over and beyond what is considered a “plain vanilla” ESG strategy, with an expansion in their valuation multiples relative to peers.

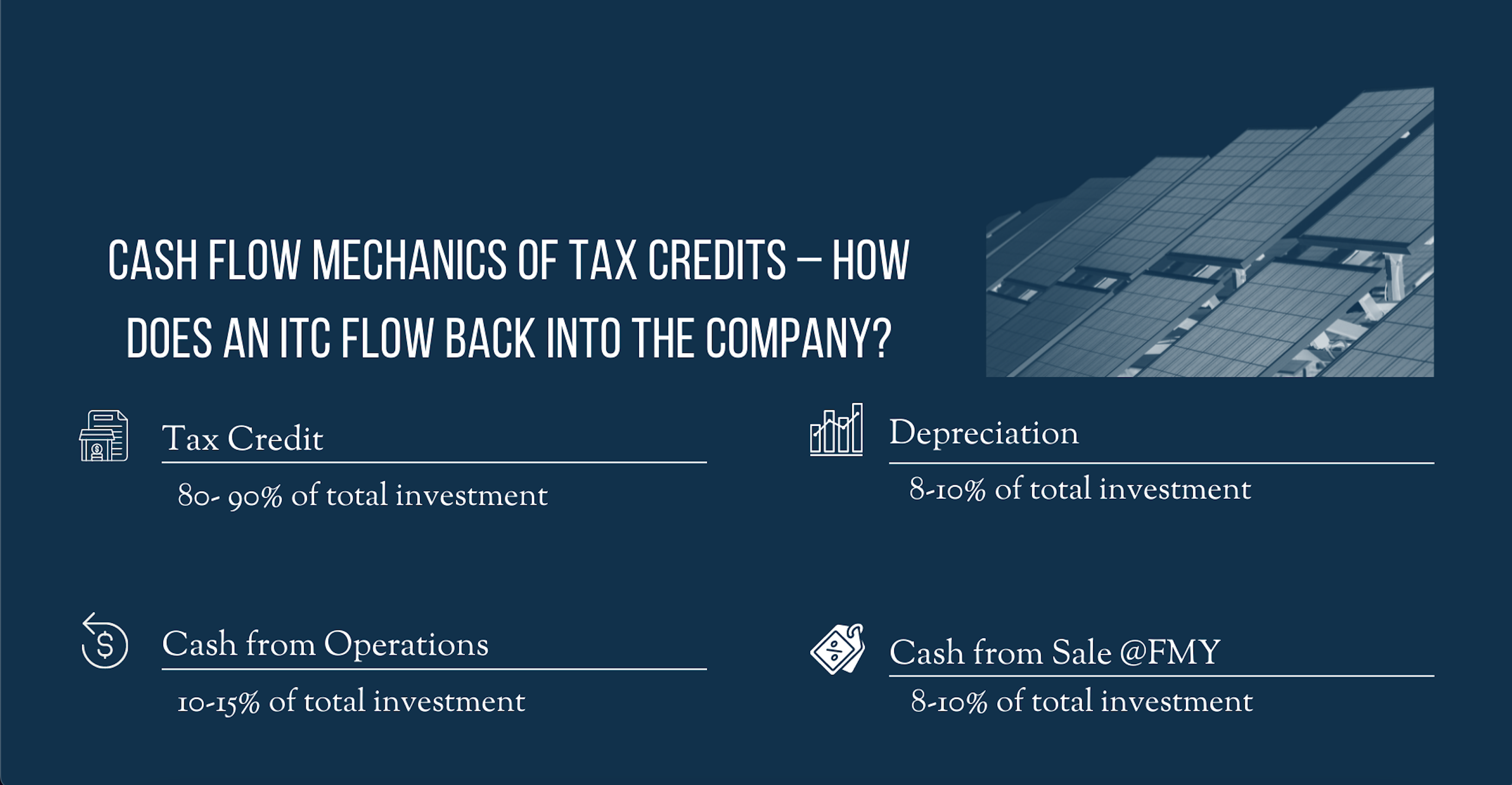

Balance Sheet Preservation – When a company uses its cash balance to pay income tax payable, the balance sheet will shrink, there will be a decline in the company’s cash balance on the asset side, and a corresponding reduction in its income tax payable account on the liability side. In contrast, by accessing tax credits, a company will be able to preserve that money on its balance sheet as an asset for the duration of the program (the Compliance Period). Cash balance will go down to invest in the tax credits, but this decline is offset by the booking of a new productive asset on the balance sheet. In other words, tax credits allow a company to turn its tax liability into a cash flowing asset with well-managed risks and competitive risk-adjusted returns.

Offset Extraordinary, Non-recurring, One-Time Tax Events – Tax credit strategies can be very effective to offset tax events caused by short-term, one-time or extraordinary corporate events, such as M&A transactions. If, for example, a company sells a division or subsidiary for a significant profit that leads to a large tax bill, it should plan to utilize tax credits to offset this liability. Solar ITCs lend themselves perfectly to this strategy given their one-year “earn out” period (a company can take 100% of the tax credits derived from a solar project when they are generated, which usually happens within the first year).

ESG Benefits of ITCs

Stakeholder demand for bona fide ESG strategies has never been stronger. Governments, intergovernmental organizations, regulators, private sector companies, academia, associations, the media, and individual citizens are all clamoring for action.

Unfortunately, there is no consensus on how to standardize, measure, compare, judge, or report ESG strategies. Efforts are underway to fix this, and some rating agencies have developed models and analytics to become the market standard, including S&P Global ESG Ratings, Bloomberg Sustainalytics, MSCI ESG Ratings, Salesforce Sustainability Cloud, among others. There is also an initiative proposed by the SEC to avoid greenwashing by requiring ESG disclosure rules for all public companies. That said, much work has yet to be done.

Materiality – the quality of being relevant or significant – is the one concept that everyone is supporting. Heavier weightings should be assigned to ESG initiatives that are tangible, relevant, and significant. The same applies to disclosure mandates: these should be limited to financial matters of a company, and therefore include only those that have an impact on a company’s financial condition, current and anticipated cash flow (investments or expenditures), or operating performance.

Under this scenario, one in which every corporate citizen must declare and commit to a material ESG strategy, companies’ approaches seem to be all over the place. In glossing over Sustainability and Corporate Responsibility Reports, one can see that most companies have adopted a “plain vanilla” ESG strategy (i.e., changing to LED bulbs, sourcing renewables, recycling trash, changing personnel habits, installing solar on HQ roofs, obtaining LEED Certifications, etc.) while some have committed to a more “in-depth” ESG Strategy that includes quantifying and addressing Scope 1, 2 and 3 emissions and evaluating new low-carbon technologies. Only a handful of companies have implemented an ITC strategy, which is hard to believe given that it checks off many, if not all, of the bona fide ESG requirements.

ITC investing is ESG investing! ITCs are a transparent, tangible and relevant investment that has an actual impact on the cash flows and the financial position of a company, meeting the highly coveted materiality hurdle. Moreover, ITCs represent private sector allocations of capital in the deployment of renewable energy, helping communities and the environment and creating jobs in the local economy.

In sum, ITCs generate financial benefits for US corporations, but they also underpin a visible ESG strategy — one that can be proudly displayed and showcased annually in a corporation’s Sustainability or Corporate Responsibility Report.